Notes Payable That Are Due in Two Years Are:

When the debt is longterm payable. Prior chapters illustrate notes payable of short duration.

A Beginner S Guide To Notes Payable The Blueprint

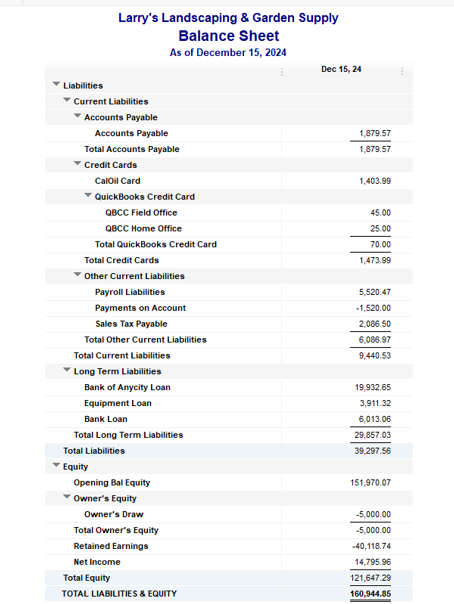

A a note payable for 100000 due in 2 years b a 10-year mortgage payable of 300000 payable in ten 30000 annual payments c interest payable of 15000 on the mortgage and d accounts payable of 60000.

. Accounting questions and answers. As we see from the above example CBRE has a current portion of notes of 13394 million and 1026 million in 2005 and 2004. The principal of notes payable.

- Sales tax payable - notes payable due in two years - prepaid insurance - the current portion of long-term debt - deferred revenues. ABC Company signed a 5-year note payable for 80000 at 9 annual interest. For each obligation indicate whether it should be.

Notes payable due in two years. It would be common to find two- three- five-year and even longer term notes. Firstly the company puts notes payable as a short-term liability.

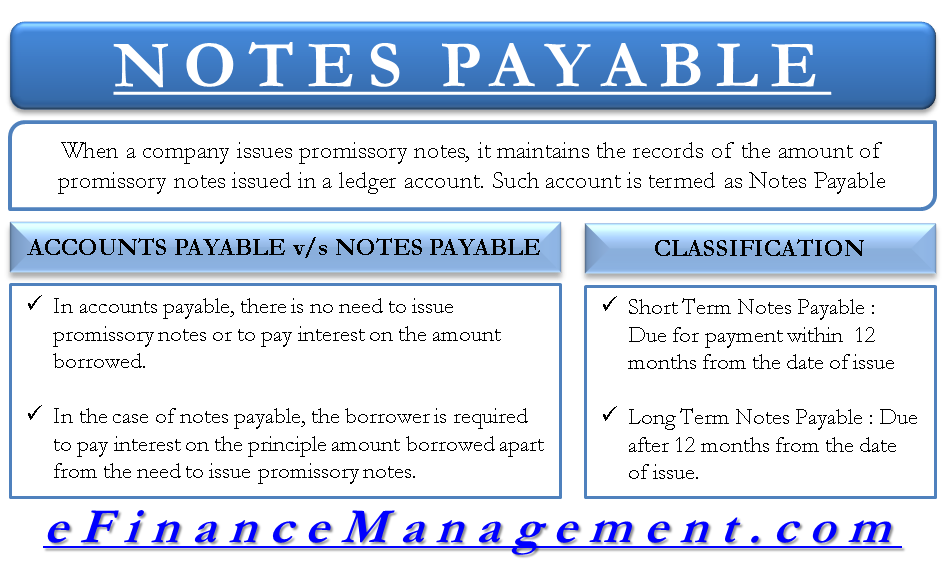

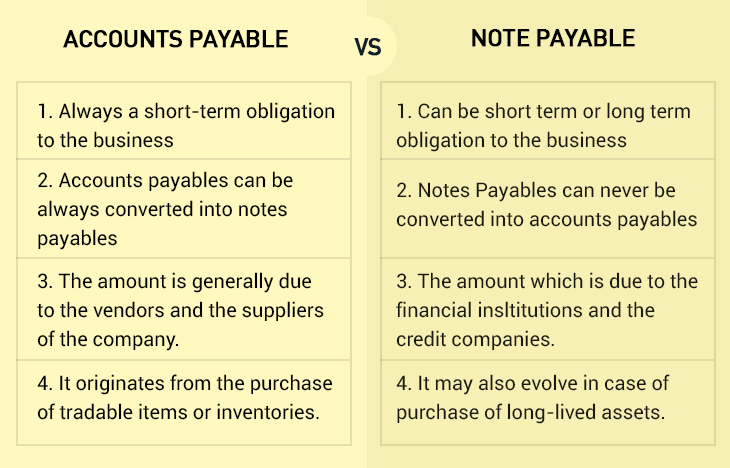

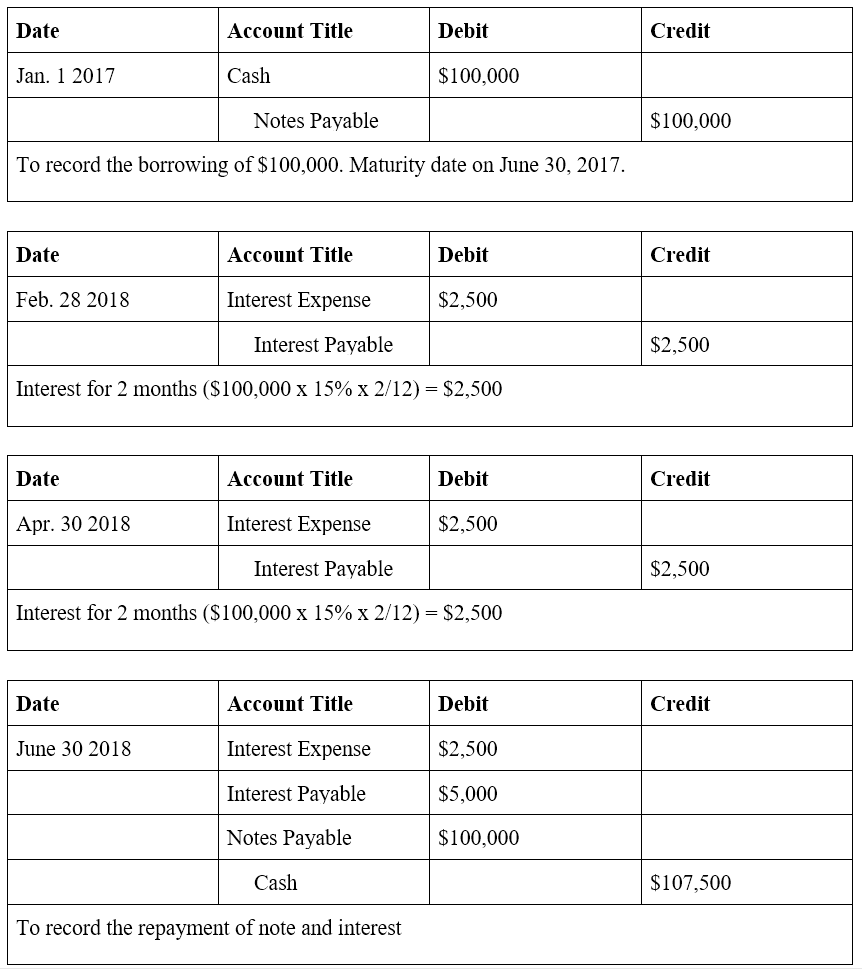

The amount borrowed is recorded by debiting Cash and crediting Notes Payable. Or e vigs taken by a loan shark in Jersey. When the note is repaid the difference between the carrying amount of the note and the cash necessary to repay that note is reported as interest expense.

The note payable has a stated interest rate of 9 payments are made quarterly first payment was issued after 3 months on December 30 in the amount of 264200 and the question is asking for the note payable amount to be recorded on the balance sheet on December 31 of the same year. Notes Payable due within two years are classified as _____ asked Sep 22 2015 in Business by Yotun. Notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date.

Therefore it must record the following adjusting entry on. Short-term notes payable have a one-year maturity date. The loan is then recorded as a note due on the balance sheet by the manufacturer.

These notes may evidence a term loan where interest only is paid during the period of borrowing and the balance of the note is due at. The following entries would record the loan the accrual of interest on December 31 and its payment on March 1 of the next year. A note payable is classified in the balance sheet as a short-term liability if it is due within the next 12 months or as a long-term liability if it is due at a later date.

Are required to issue a note as a substitution of a past-due account payable. The balance in Notes Payable represents the amounts that remain to be paid. The National Company prepares its financial statements on December 31 each year.

Notes payable that are due in two years are. For example assume the companys accounting year ends on December 31. Presentation of Notes Payable.

After 45 days of nonpayment by Company B both parties agree that Company B will issue a note payable for the principal amount of 300000 at an interest rate of 10 and with a payment of 100000 plus interest due at the end of. When a long-term note payable has a short-term component the amount due within the next 12 months is separately stated as a short-term. Company A sells machinery to Company B for 300000 with payment due within 30 days.

Accounts payabletrade 560 Accumulated depreciation 80 Additional paid-in capital 485 Allowance for uncollectible accounts 20 Cash dividends payable 30 Common stock at par 15 Income tax payable 65 Notes payable long-term 800 Retained earnings 308 Deferred revenues 40 _____ _____ TOTALS 2403 2403. However borrowers may desire a longer term for a loan. Disclosure note A contingent liability with a probable likelihood of occurring within the next year and can be estimated.

Accounting for an interest-bearing note is simple. In your notes payable account the record typically specifies the principal amount due date and interest. A current liabilities B current assets C long-term liabilities D long-term assets.

It is useful to notice that the maturity of notes payable can be longer than one year. Since a note payable will require the issuerborrower to pay interest the issuing company will have interest expense. Answered Sep 22 2015 by Keezel.

Short-term notes payable are due within 12 months. The notes payable are not issued to general public or traded in the market like bonds shares or other trading securities. Payment durations for notes payable may be divided into two types.

The promissory note is payable two years from the initial issue of the note which is dated January 1 2020 so the note would be due. Current Unused line of credit. Example of Notes Receivable.

Sales tax payable the current portion of long-term debt deferred revenues. The payment made on December 30 is part interest part. Long-term notes payable mature in more than one year but generally in five years or fewer.

At the end of the 3 month term the total interest of 300 would have been accrued. B long-term intangible assets. BE11-1 Cardinal Company has the following obligations at December 31.

Long-term Advance payments from customers. In this case the note payable is issued to replace an amount due to a supplier currently shown as accounts payable so no cash is involved. Long-term notes payable are due after a year.

Needham Company issued a 10000 90-day 9 note on December 1. In accounting Notes Payable is a general ledger liability account in which a company records the face amounts of the promissory notes that it has issued. As the notes payable charge interest each month interest of 300 3 100 needs to be accrued.

Hence based on the due date of the principal notes payable can be classified into two short-term notes payable and long-term notes payable which is presented in the two different sections of the balance sheet. Current A contingent liability with a reasonably possible likelihood of occurring within the. Notes payable can either be short-term or long-term depending on the timing.

An extension of the normal credit period for paying amounts owed often requires that a company sign a note resulting in a transfer of the liability from accounts payable to notes payable. The interest represents 8 of 10000 for half of a year January 1 through June 30. The company puts it as a short-term liability when the duration of that particular note payable is due within a year.

What is the interest expense for December 31 2013 if.

Notes Payable Definition Classification Example Efinancemanagement

Notes Payable Principlesofaccounting Com

Comments

Post a Comment